The race is on - and Khiron is positioning to win

As companies like Trulieve, Curaleaf and Canopy establish themselves as leaders in their respective markets, we believe the race for a dominant international player is still in the starting blocks. With a global opportunity in excess of US$340B (source: New Frontier Data), Khiron is positioning to take an early lead in the global race by maintaining a dominant position in Latin America and growing its presence in Europe. As the company executes on this global strategy, we believe two positive outcomes could emerge.

- The share price re-rates. Strong revenue and cash flow growth should result in a higher multiple and valuation. Below, we discuss the exponential growth opportunity and catalysts that could generate a step-change in revenues.

- A suitor comes calling. As North American growth moderates, Canadian LPs and US MSOs will be looking for their next leg of growth. As a dominant player in Latin America and key player in Europe, Khiron's operations will be highly complementary to North American cannabis companies. This could be a major catalyst for the company down the road.

Rome wasn't built in a day

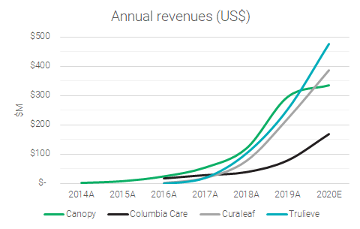

One thing investors should keep in mind is that growth doesn't happen overnight. Check out the chart below, which showcases the revenue growth profile of several market leaders – slow to start but with a very steep ramp up. We’ve compiled some other interesting take-aways from historical revenue and patient data.

Source: Company reports, ycharts.com. Trulieve & Columbia Care 2020E revenues as per management guidance, Canopy & Curaleaf consensus

Key take-aways

- A good kind of exponential growth. We've all been hearing about exponential growth thanks to Coronavirus; however, leaders in the cannabis space have been generating a positive kind of exponential growth - revenues! Case in point, while it took Trulieve at least eight (8) quarters to reach US$25M in quarterly sales, in Q2/20 the company increased revenues by ~US$25M in a single quarter! Trulieve has posted a staggering average quarterly revenue growth rate of 56% over the last 3 years (i.e. since Q2/17 when revenues first surpassed the US$2M/quarter mark) which is particularly impressive given that growth has been largely organic. Looking at several other industry leaders, we find that Curaleaf's quarterly revenue growth averaged 34% over a 3-year period (Q1/17 to Q1/20, driven in part by acquisitions) while Canopy has averaged 30% per quarter since crossing the $2M revenue mark back in Q3/15.

- Market leaders emerge quickly. Trulieve has over 320,000 active patients, a 50% market share in Florida and is on track to do ~US$465-485M in revenues in 2020. This compares to $20M in revenues in 2017 and equates to patient growth of nearly 300% over the last two years. Similar to Trulieve, Khiron is working to build patient loyalty and is an early leader in Latin America as the only company currently authorized in country to sell medical cannabis with a large base of in-house patients. While most of our domestic competitors are focused on the export market, we have a captive audience and are fielding up to 5,000 inquiries a month while working diligently to convert inbound "canna-curious" Colombians to Khiron Med patients.

- Khiron's clinic patient base is greater than Canopy's peak cannabis patient count.In Sept 2018, Canopy's domestic patient count peaked at 84,000 after ~18 quarters of sales. At that point, the company's revenue run rate was nearly $100M/year in medical sales. While Canopy's patient base made it a market leader and helped attract the likes of Constellation Brands, Khiron currently facilitates over 155,000 annual patient transactions¹ at its ILANS and Zerenia clinics, where most patients have conditions suitable for medical cannabis. Imagine if Canopy had over 100k patients under its care and was the only game in town in all of Canada. We think that would have garnered some serious investor attention!

- Game changers create step changes. Between the quarters ended Sept and Dec 2018, Canopy's revenues increased more than 250% ($60M) in a single quarter when Canada legalized cannabis. Similar to the regulatory changes that resulted in a step change for Canopy (i.e. adult-use legalization) and Trulieve (i.e. changes to dispensary limits and the start of flower sales), insurance coverage and international regulatory changes are major opportunities that could create step changes for Khiron.

“A start-up's only advantage is SPEED. Everyone else has MORE resources than you”

While Khiron doesn’t have billions at its disposal, we believe a few things bode well for us: the company's first mover advantage, captive patient base, skilled management team, and shift toward capital preservation.

First to market

- As we mentioned above, effective May 2020, Khiron became the first & only cannabis company authorized to sell high and low-THC medical cannabis products in Colombia after hitting 29 different milestones along the way. We believe this is a major head start toward market dominance!

- Khiron is executing in Europe, a market that could be worth US$22B by 2024(source: Prohibition Partners). In the UK, the company issued the first Rx under Project Twenty21, while sales are expected to start this quarter in Germany. Khiron is also approved for Peruvian sales and is awaiting a final regulatory hurdle before starting sales in Brazil.

- On the wellness side, Khiron launched Latin America’s first mass-market branded CBD skincare line. Since then, the company has significantly increased distribution, with 11 SKUs now being sold on four continents, five countries (including Colombia, the US, the UK, Spain and Hong Kong), over 350 retail locations and numerous online channels. The brand has been recognized as a global CBD cosmetic market player, alongside L'Oreal SA and The Estée Lauder Companies (source: Technavio Research).

Focused on patients and brands versus grams

- Unlike most of its peers, Khiron is focused on the end consumer versus cultivation. As production becomes a commodity, the company believes that building a loyal following of patients and doctors will create a competitive moat.

- By prioritizing early entries and brand development, the company is taking an asset light model. This means it can invest more capital toward its "moat".

Management with the experience and hustle

- The company is led by co-founder and Chief Executive Officer, Álvaro Torres, an industrial engineer who has overseen more than $1B in infrastructure projects. Alvaro is passionate about creating a seamless patient experience, optimizing processes and implementing systems to measure what matters. With the ability to roll up their sleeves to get the job done, Alvaro and his team have achieved a plethora of firsts in Colombia.

- The company’s Board of Directors includes former President of Mexico, Vicente Fox, who, as the former CEO of Coca-Cola Latin America, drove Coke to the #1 market share forover 30 years. “Women Get Onboard” founder Deborah Rosati brings more than 30 years of experience in technology, consumer, retail, cannabis, private equity and venture capital. The management team also holds a large interest in the company with 14% of shares outstanding.

Stretching every dollar

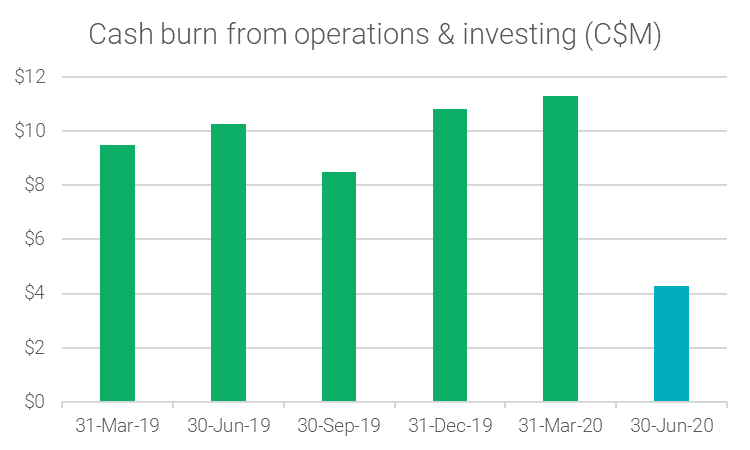

- As US operators post large revenue gains amid the global pandemic, capital has flowed toward MSOs, beating up small-cap cannabis stocks along the way. Given current market conditions, Khiron is focused on stretching its balance sheet and living within its means. As shown in the chart below, we continue to reduce our cash burn significantly with plans of being cash flow neutral by Q4/20 (COVID-depending).

Source: Khiron - Company Reports.

If investors could go back in time and invest in Canopy, Curaleaf, or Trulieve, would they? Perhaps it’s not too late to find the next dominant player in an emerging market.

Cautionary Notes

Forward-Looking Statements

This press release may contain certain "forward-looking information" and "forward-looking statements" within the meaning of applicable securities legislation. All information contained herein that is not historical in nature may constitute forward-looking information. Khiron undertakes no obligation to comment on analyses, expectations or statements made by third-parties in respect of Khiron, its securities, or financial or operating results (as applicable). Although Khiron believes that the expectations reflected in forward-looking statements in this press release are reasonable, such forward-looking statement has been based on expectations, factors and assumptions concerning future events which may prove to be inaccurate and are subject to numerous risks and uncertainties, certain of which are beyond Khiron's control, including the risk factors discussed in Khiron's Annual Information Form which is available on Khiron's SEDAR profile at www.sedar.com. The forward-looking information contained in this press release is expressly qualified by this cautionary statement and is made as of the date hereof. Khiron disclaims any intention and has no obligation or responsibility, except as required by law, to update or revise any forward-looking information, whether as a result of new information, future events or otherwise.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this press release.

¹ Medical transactions include consultations, surgical procedure, therapeutic support, diagnostic service, etc.