Demystifying the European Market and Khiron’s place in it

In August 2019, Khiron hired a veteran European team to execute on an asset light entry into Europe. Since then, our European team has made significant progress including:

- Developing a robust supply chain,

- Being selected to participate in Europe’s largest medical cannabis registry (Project Twenty21),

- Issuing one of the first medical cannabis prescriptions in Scotland through Project Twenty21, and

- Launching our physician education program.

In this note, we’re going to demystify the European market and let you in on a few secrets: why we are so excited about the European market (specifically, the UK and Germany) and how we’re different from our competitors. So, let’s dig in!

Why Europe?

From Day 1 at Khiron, we’ve been committed to building the dominant cannabis brand in Latin America. While this vision remains, we also believe the platform we’ve developed can be leveraged in select international markets. We are very optimistic about the British and German markets, where we see an opportunity to establish ourselves as an industry leader and early entrant.

What separates Khiron from the pack?

We continue to believe that international markets will be the next sector rotation within the cannabis industry and that we are uniquely positioned to succeed in Europe given our highly experienced team, asset light approach, differentiated medical education platform and focus.

- Team. In September 2019, we hired Tejinder Virk as President of Khiron Europe, and Franziska Katterbach as Chief Legal Officer of Khiron Europe. Tejinder and Franziska, who were formerly key contributors to Canopy Growth’s European operations, have built a team that is highly experienced within the European cannabis industry. Given Europe’s complex regulatory environment, and the need for local relationships, we believe our team can compete head-to-head with other players in the region.

- Asset light approach. A key differentiator in Europe is our asset light approach, where we are focused on building a diverse supply chain to complement an exceptional patient experience. We don’t own cultivation or distribution assets in Europe, which saves time and money and ensures an early entry into key markets, where we will compete on service and patient experience. Currently, we are working with multiple EU-GMP certified partners that can manufacture our products with specified genetics. Over the longer term, we may look to import Colombian product; however, building a loyal patient following over the near term is a top priority.

- Medical education platform. Doctor education continues to be a core strategy and competency for Khiron, and in Q3/20 we launched our globally validated e-learning program in the UK in partnership with Medical Cannabis Clinicians Society (MCCS). Leveraging real-life patient data from our clinics in Colombia, along with our highly trained medical team, we are providing doctors with a differentiated continuing education experience that bridges the gap between theoretical education and the practical aspects of prescribing medical cannabis.

- Focus. We are focused on building physician and patient loyalty in two key markets: Germany and the UK. While our asset light approach means we could expand to other European markets, we see plenty of opportunity in the UK and Germany. In contrast, many of our competitors have dedicated significant resources to building cultivation assets while simultaneously producing recreational products alongside EU-GMP medical products. Our robust European supply chain means our products meet the highest quality standards and that we can focus our resources on acquiring and retaining patients, or targeting new markets as opportunities arise. In the UK, we expect to be one of the leading brands in the country through our participation in Project Twenty21, an observational study that aims to enroll 20,000 patients by 2021. In Germany, we will soon launch our proven medical education platform, where we plan to compete on product quality, service and medical education.

Market overview

United Kingdom

Khiron is entering the UK market as one of five suppliers to Project Twenty 21 (T21), a patient registry that aims to assess the efficacy of medical cannabis by monitoring the outcomes of 20,000 medical cannabis patients. We believe that medical cannabis in the UK is positioned for massive growth over the next five years, with just 277 cannabis prescriptions1 being issued in 2019 (versus the 1.4m people believed to be self medicating)2. As an early entrant, Khiron has an unparalleled opportunity to build a leading position by delivering an exceptional and differentiated patient and physician experience.

- A market in its infancy. While medical cannabis has been legal in the UK since 2018, a recent Care Quality Commission report found that in 2019 only 18 cannabis prescriptions were issued through the NHS in addition to 259 prescriptions issued through the independent sector. Project Twenty21 aims to change this by facilitating patient access and collecting data on the safety and efficacy of cannabis-based products for medicinal use (CBPMs). To date, over 8,000 individuals have registered their interest in Project Twenty21; however, at a 1-2% market penetration, the UK market could eventually reach 0.7-1.4M patients.

- Targeting large-scale access. The T21 registry will make up Europe’s largest body of evidence on the safety of cannabis-based medicine. Project Twenty21’s founder, Drug Science, hopes the findings will help integrate cannabis into UK healthcare. While only specialists can prescribe through Project Twenty21, the registry reduces liability for doctors and broadens the breadth of conditions for which a physician may prescribe.

- We’re live! Set up in November 2019, the project is open to patients who suffer from conditions such as chronic pain, PTSD, anxiety, Multiple Sclerosis, Tourette’s, and Substance Use Disorder. On August 4, 2020, Project Twenty21 officially launched and registered its first patient for a medical cannabis prescription. Khiron made history by issuing one of the first prescriptions through the study. Additionally, Khiron has partnered with MCCS, an independent, clinician-led organization in the UK, to provide medical cannabis education and training to participating doctors across the UK through its proven cloud-based learning platform.

- Affordable. CBPMs will be offered at £150 per product per month, which equates to ~C$3,000/year. Patients will be able to choose from dried flower with varying amounts of THC and CBD, CBD oils, and synthetic preparations.

Germany

Since legalizing medical cannabis in March 2017, Germany has historically been the largest medical cannabis market outside of North America. Key characteristics of the German market include high growth rates, insurance coverage, and world class quality standards.

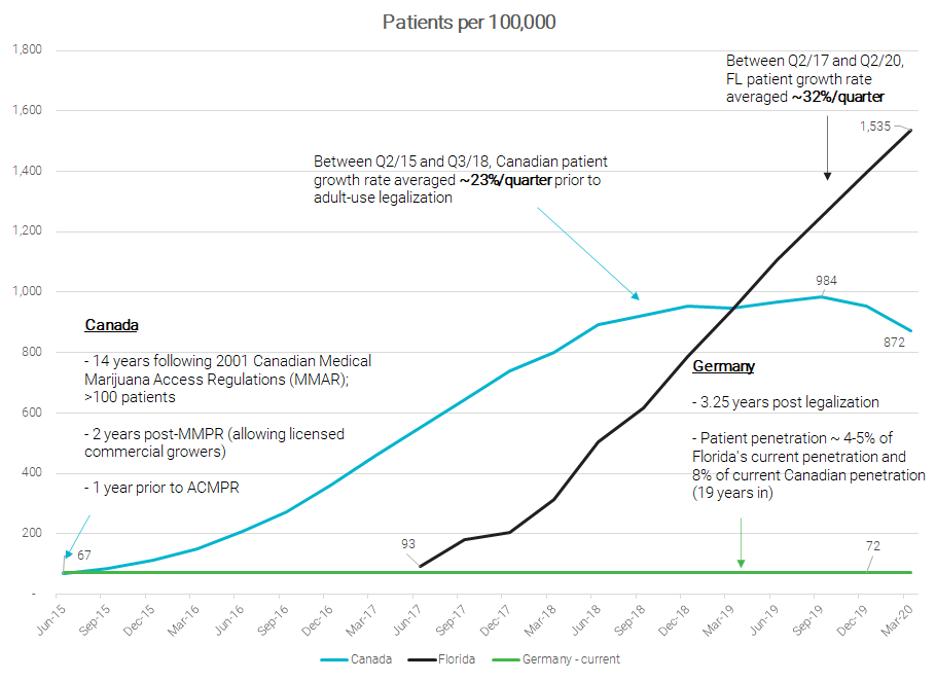

- High growth potential. Since 2017, cannabis sales in Germany have been doubling every year, reaching a record high of just under €15M in March 2020. Prohibition Partners see the market reaching €7.7 billion (C$12B) by 20283 versus the current run rate of €150M. As context, that is roughly 4-5x the current Canadian recreational run rate! Additionally, recent patient estimates of 60,000 would put Germany’s patient penetration roughly on par with Canada in mid-2015 and Florida in mid-2017. As shown below, these markets experienced high growth rates as patient barriers fell and product selection and access improved. While it is difficult to predict an appropriate growth rate, we do expect to contribute to market growth through a number of corporate initiatives including physician education.

Source: Management estimates, https://knowthefactsmmj.com/about/weekly-updates/ https://prohibitionpartners.com/2020/07/29/german-medical-cannabis-imports-increase/ https://www.canada.ca/en/health-canada/services/drugs-medication/cannabis/licensed-producers/market-data.html https://www.canada.ca/en/health-canada/services/drugs-medication/cannabis/research-data/medical-purpose.html#a1

Source: Management estimates, https://knowthefactsmmj.com/about/weekly-updates/ https://prohibitionpartners.com/2020/07/29/german-medical-cannabis-imports-increase/ https://www.canada.ca/en/health-canada/services/drugs-medication/cannabis/licensed-producers/market-data.html https://www.canada.ca/en/health-canada/services/drugs-medication/cannabis/research-data/medical-purpose.html#a1 - Potential market of over 1 million. Currently, registered patients are estimated at 60,000, which is just 6% of the 1 million-patient market forecasted by Prohibition Partners by 2024. At 1.2% of the population, we think the 1M patient estimate may be conservative considering markets like Florida already have an adoption rate exceeding 1.9% (which would equate to 1.6M German patients!).

- Insurance reimbursement. In Germany, cannabis is treated like a regular medicine and is broadly covered by insurance. In fact, in 2019 60%4 of medical cannabis reimbursement applications were approved, increasing affordability and, in our view, positioning the country for rapid growth.

- Barriers, not walls. Complex regulations continue to make medical cannabis distribution a challenge. Some of the key regulatory barriers include EU GMP certification, consistent product quality, packaging, patient access, and logistics. Our team is deeply experienced and in tune with emerging regulations, which we view as a competitive advantage.

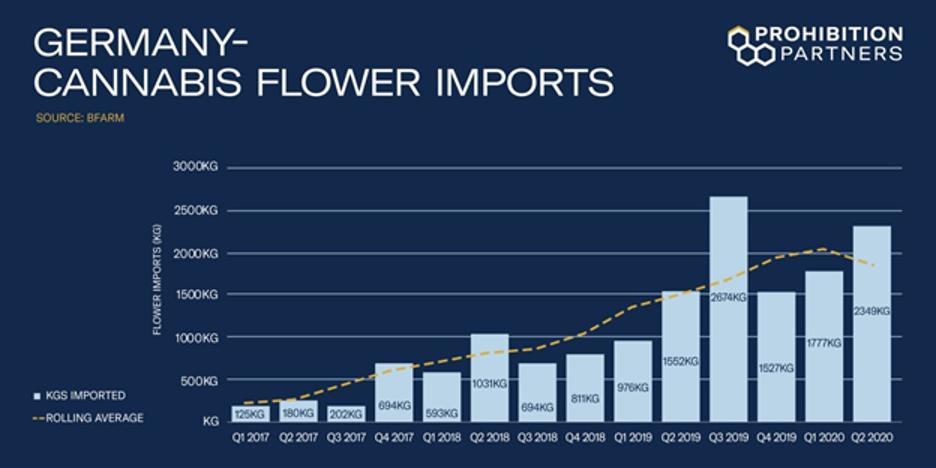

- Emerging supply chain. While the country has increased the number of producers and countries from which it sources medical cannabis, we believe the market is still dominated by single, large shipments of everchanging varieties. In our view, a more consistent supply will facilitate long-term growth. Additionally, even with a small amount of domestic production coming online, Germany is expected to be vastly dependent on imports for oils and dry flower.

- Attractive pricing environment. In 2019, the average prescription cost was €460/Rx as German insurers paid out €123M on 267,000 prescriptions5. While domestically produced products are subject to tender pricing of €2.30/gram on average, the export market remains a free market where high pricing persists.

At present, Germany is one of the largest importers of medical cannabis in the world and data shows that medical cannabis imports continue to trend upward, despite the global pandemic.

Closing remarks

Despite what some may see as a slow start to global cannabis markets, we believe a foundation has been laid for rapid growth. Industry expert and New Cannabis Ventures’ founder Alan Brochstein, CFA recently stated “We also think that the global markets have been slow to develop, but the next five years should see substantial expansion around the world and expect our attention will reflect more coverage of these markets.” By always focusing on physician education and patient experience, we intend to create a sustainable competitive advantage that will position us as a global leader!

1 https://www.cqc.org.uk/sites/default/files/The_safer_management_of_controlled_drugs_Annual_update_2019.pdf . Page 13

2 YouGov, The Centre for Medicinal Cannabis

3 https://prohibitionpartners.com/2019/10/28/the-germany-cannabis-report-key-insights/

4 https://prohibitionpartners.com/2019/10/28/the-germany-cannabis-report-key-insights/

5 https://www.labiotech.eu/interviews/medical-cannabis-regulatory-patient-demand-pricing-germany/